Tag: consultation

-

How to do Taxes as a Small Business Owner

It’s challenging enough to run a business without adding the additional complication of filing taxes each year. Making financial decisions without contacting an accountant or financial consultant can put you at risk and ultimately cost you more money. Working with your accountant throughout the year, rather than just while preparing your tax return, is the […]

-

Tips to Get Your Employees Back to Work

Assure your employees that everything will be alright. As government lockdowns ease up, people will start to come out of their homes and try to find a way back to normalcy. One thing we can expect is to come back to work. This is good news for businesses but it may also bring about some […]

-

7 Smart Ways to Save Money as a Small Business

It can be difficult for small businesses to save money from the start. They don’t always have a lot of resources at their disposal when trying to get their startup off the ground. In their first year, small business owners reported spending more than twice as much as they had anticipated. Small costs and expenses may not […]

-

The Basics of Small Business Accounting

On its most basic level, accounting is how a business keeps track of how much money is coming in and going out. Small business accounting involves the process of tracking, recording, and analyzing the financial transactions of your business. It translates numbers into a comprehensible statement about the profitability of your business. If you’re a startup company […]

-

How A Professional Can Help You Run A Business

Small business owners have a lot of responsibility when it comes to their company. They oversee operations, take on inventory, look after clients, and manage people. All this comes while running the business and coming up with ways to stay competitive and driving sales. So what happens when they hit a wall or when they’re […]

-

Payroll Guide for Small Business Owners

Payroll is the business process of paying employees. Running payroll consists of calculating employee earnings and factoring out federal and state payroll taxes. As a small business owner with employees, you need to know how to do payroll. This payroll guidewill make sure that you’re paying wages properly and stay in line with US tax […]

-

Invoicing Mistakes to Avoid

Keeping a record of your sales is important especially when it’s time to make your financial reports. Staying up to date and organized with your invoices will show you how your business is growing and can even strengthen the relationship you have with your clients. When you run a business, there are mistakes to avoid […]

-

Helpful tips when launching your own business

Got plans to start something new? You’ll need to check out these helpful tips when launching your own business. It’s essential that you plan out your business before you even start it. Make sure all the documents and your offer will be something that stands out. Opportunities arise at many occasions and grasping that opportunity […]

-

Fundamental Accounting Principles

Generally accepted accounting principles (GAAP), are common standards and procedures issued by the Financial Accounting Standards Board (FASB). It encompass the details, complexities, and legalities of business and corporate accounting. Although there are plenty of guidelines that make up GAAP, these 10 basic principles are the most commonly practiced by any business accountant. Basic Accounting Principles 1. […]

-

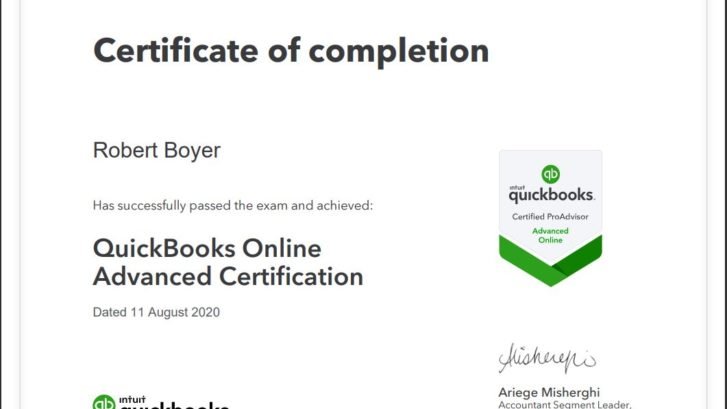

Need a QuickBooks ProAdvisor? We got you covered

Get a QuickBooks ProAdvisor to help you run your business Robert Boyer is an Advanced Certified QuickBooks Online ProAdvisor. This is the highest level of certification that Intuit offers for ProAdvisors and only about 2% of Quickbooks Pro Advisors are Advanced Certified. Businesses run better with QuickBooks. They do even better with a QuickBooks ProAdvisor by […]