Tag: Philadelphia

-

Year-End Accounting Tips

Year-end accounting is a critical time for businesses to ensure that their financial records are accurate and compliant. It’s a time to wrap up the current year’s financial activities while also preparing for the upcoming year. Here are some essential year-end accounting tips for businesses to consider: 1. Reconcile Your Accounts Bank and Credit Card […]

-

Tips on effective debt management for a business owner

Effective debt management is crucial for business owners to maintain financial stability, sustain growth, and avoid cash flow issues. Here are some key tips for managing business debt: 1. Understand Your Debt Categorize Your Debts: Separate short-term debts (e.g., working capital loans) from long-term debts (e.g., equipment loans, mortgages). This helps you understand repayment timelines […]

-

Preventing Expense Fraud

Preventing expense fraud is critical for protecting your business’s financial health and ensuring that employees or contractors don’t take advantage of loopholes in the system. Expense fraud can take various forms, such as inflating expenses, submitting fake receipts, or making personal expenses appear as business-related. Here are 5 key steps you can take to prevent […]

-

How to hire a good bookkeeper

How to hire a good bookkeeper Hiring a bookkeeper can be a great way to take the burden of managing your finances off your shoulders, but it’s important to choose the right bookkeeper for your business. In this blog post, we’ll explore how to hire a good bookkeeper. 1. Determine whether you need a bookkeeper […]

-

Quarterly Estimated Tax Payments

Quarterly estimated tax payments are payments made to the IRS and, in some cases, to state tax authorities, on a quarterly basis to cover your tax liability for the year. These payments are typically required for individuals and businesses that do not have taxes withheld from their income, such as self-employed individuals, freelancers, and business […]

-

What is an Emergency Fund?

What is an Emergency Fund An emergency fund is a savings account that is set aside specifically for unexpected events or emergencies. It’s money that you can access quickly when you need it most, without having to borrow money or sell your assets. In this blog post, we’ll explore what an emergency fund is, […]

-

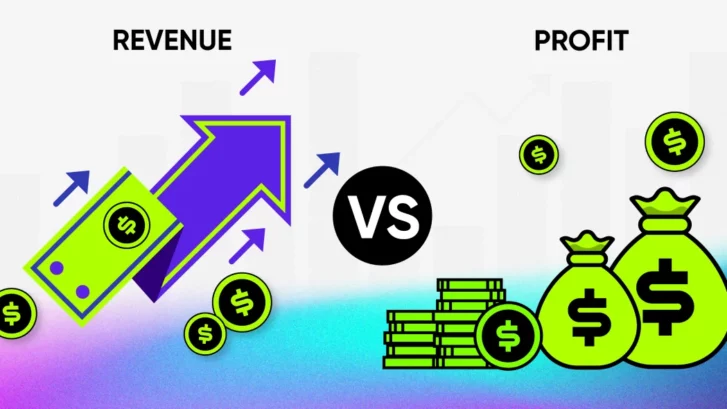

Revenue vs Profit

Revenue vs Profit Revenue and profit are two important financial concepts that every business owner should understand. While they are related, they are not the same thing. Revenue is the total amount of money that a company takes in, while profit is the amount of money that the company has left after expenses have been […]

-

Managing Cash Flow

Managing Cash Flow Managing cash flow is critical for the success of any business. Cash flow refers to the movement of cash in and out of a business, and it is essential to maintain a positive cash flow to ensure that the business can pay its bills, invest in growth, and remain solvent. In this […]

-

What is Sensible Investing?

Sensible investing is an approach to managing investments that prioritizes long-term growth, risk management, and financial stability. It typically involves several key principles: Diversification: Spreading investments across a variety of asset classes, such as stocks, bonds, real estate, and cash equivalents, helps reduce the impact of any single investment’s poor performance on the overall portfolio. […]

-

A Guide To Sending Out 1099s

Sending out 1099 forms is an important tax-related task for businesses in the United States. These forms are used to report payments made to non-employee service providers, independent contractors, and other individuals or entities. Here’s a business guide to sending out 1099s: Determine Who Needs a 1099: Identify all individuals or entities to whom your […]