Tag: Taxes

-

TAX EXTENSIONS DEADLINE

TAX EXTENSIONS for 2023 are due October 15, 2024 – Deadline to file your extended 2023 tax return to avoid possible penalties. Silicon Harbor can help with preparing your financials for tax preparation and continue to assist with monthly bookkeeping maitenance. Silicon Harbor Business Services is based in Mount Pleasant, SC. We provide solid, practical advice […]

-

Tax Preparation: How can accurate bookkeeping help with tax preparation? What documentation should I keep for tax purposes?

Accurate bookkeeping is essential for proper tax preparation. It ensures that your financial records are organized, complete, and in compliance with tax regulations. Here’s how accurate bookkeeping helps with tax preparation, along with the documentation you should keep for tax purposes: Benefits of Accurate Bookkeeping for Tax Preparation: Accurate Reporting: Properly recorded transactions ensure that […]

-

Guide to Tax Returns for Small Business Owners

Tax season may come as a challenge if you’re a small business owner and most will find it to be such a headache. If this is your first tax season, you will need to check out this guide to tax returns. Prepare your documents to be filed accurately and in a timely manner so that […]

-

Useful Small Business Tax Tips and Tricks

It’s wonderful when you start to manage your own small business. You play the biggest role whenever business decisions are made and you have the chance to explore and expand your network. However, it’s not all sunshine and daisies. Avoid the headache by taking advantage of some simple and useful small business tax tips that […]

-

How to do Taxes as a Small Business Owner

It’s challenging enough to run a business without adding the additional complication of filing taxes each year. Making financial decisions without contacting an accountant or financial consultant can put you at risk and ultimately cost you more money. Working with your accountant throughout the year, rather than just while preparing your tax return, is the […]

-

Estimated Tax and What You Need to Know

Estimated tax is a quarterly payment of taxes due that is based on the filer’s stated earned income for the period. The majority of business owners who are required to pay quarterly taxes are small business owners, freelancers, and independent contractors. Many business owners are surprised by tax bills when they first start out or when they begin to […]

-

What is an IRS 1099 form?

A 1099 form reports various types of income generated by a taxpayer during the year. An IRS 1099 is significant since it is used to report a taxpayer’s non-employment income. 1099 may be sent for cash dividends received for stock ownership or interest income generated from a bank account. The many types of 1099s. 1099-INTA […]

-

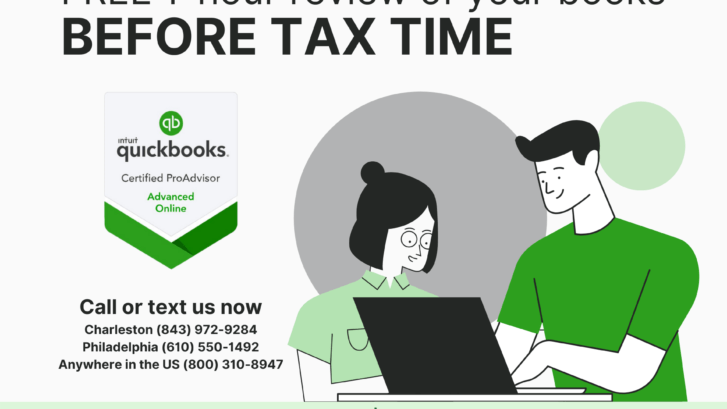

Get ready for Tax Season

Start off the New Year and prepare for the coming tax season with a 1-hour FREE review of your books from Silicon Harbor Business Services! We understand that you may not have a lot of time on your hands and finding the right team to help with your accounts is important. Let’s sit down and […]

-

A guide to taxes for Business Owners

Consider these tips when filing you business taxes. Taxes are a normal part of daily business operations. Every business owner, whether small or large, must oblige to such rules to keep the company running. Here are some tips to consider as when paying for business taxes. Completing and Filing Your Business Tax ReturnPaying Self-Employment TaxPaying […]

-

Getting a Professional for your Business

Accountants keep things in check while you can focus on operating your business. They take care of your taxes and make sure that deadlines are met when it comes to money matters. Consider getting an accountant to keep your business running smoothly and to help you make the right business decisions. • An accountant can […]